Gold Price Analysis: XAU/USD at a critical technical juncture

- Precious metals benefit from US dollar weakness to rival currencies.

- The stagflation themes feed through into the precious metals hedge.

- Gold price remains bound by daily dynamic support.

Gold is subdued and rests in familiar territory awaiting the next major catalyst to kick start it into gear within bullish territory towards the psychological $1,800 level. At the time of writing, XAU/USD is trading at 41,769 and flat in Asia, so far.

Precious metals are finding support from the stagflation theme that has been brewing in recent weeks as well as weakness in the US dollar. The greenback had struggled against its rivals on Tuesday in a bout of profit-taking as rival currencies of central banks that are on the verge of lift-off play catch-up. The moves in forex are denting the US dollar's appeal that had otherwise benefitted by expectations of sooner-than-previously expected interest rate hikes.

''Market pricing for Fed hikes is far too hawkish,'' analysts at TD Securities argued. ''This suggests gold is an ideal hedge against rising stagflationary winds, and reasons to own the yellow metal are growing more compelling as Fed pricing is likely to unwind.''

US Oil (WTI) extends higher

The analysts added that a ''cold winter could send energy prices astronomically higher, potentially pricing-out industries and fueling price asymmetries in markets — which translates into a fat right tail for gold prices. Chinese brokers have also increased their net length in SHFE gold, pointing to increased appetite for the yellow metal amid a growing wall of worry.''

Gold technical analysis

For an in-depth technical analysis of gold, see here: Gold Chart of the Week: XAU hit the $1,800 target, now what?

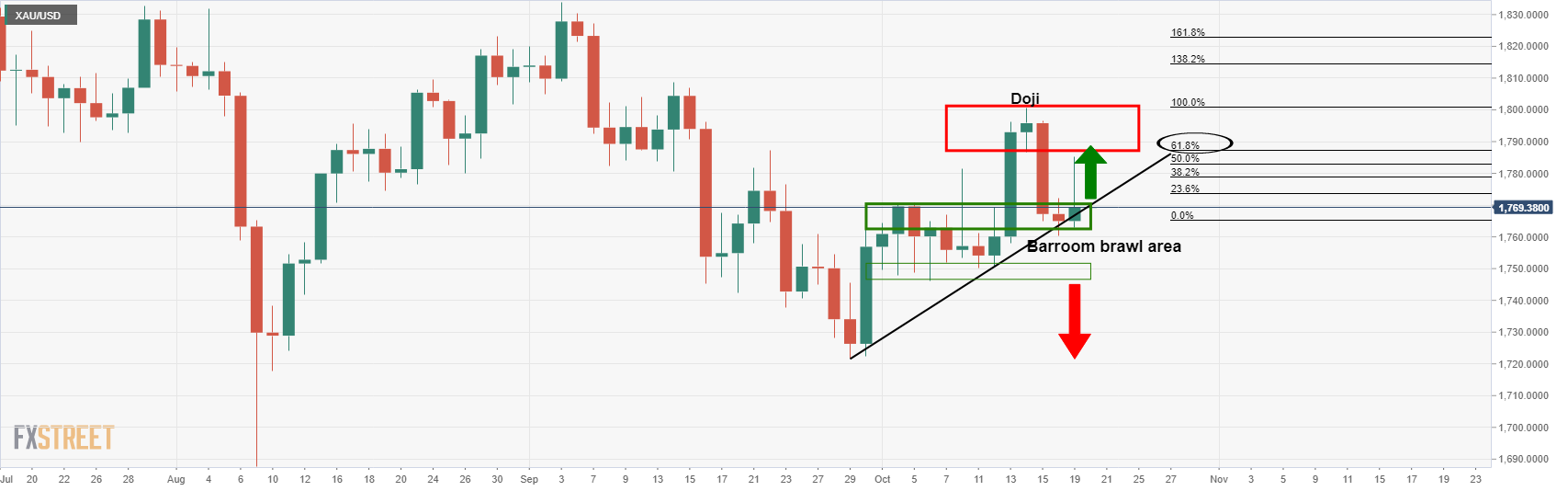

However, at a snapshot, we are likely to see some consolidation to continue to play out:

The price is consolidated unfamiliar territory mid-week and resting by the dynamic trendline support. A move beyond $1,800 is required if the bulls are going to take charge again, or otherwise, a break below the barroom brawl area and $1,750 will open the risk of a downside continuation.

This can be illustrated better from a weekly perspective, as follows:

The price has met a 61.8% Fibonacci retracement of the prior bearish impulse. This is significant and could lead to a break below the dynamic support. A fresh bearish impulse to the downside in the coming weeks would, however, be in contrast to the fundamental stagflation theme.