Gold Price Forecast: XAU/USD recovery needs acceptance above critical $1,792 barrier – Confluence Detector

- Gold price corrects from four-week lows but upside appears bumpy.

- Renewed Omicron covid variant fears spark safe-haven demand for gold.

- Gold Price Forecast: Still depressed despite the better market mood.

Gold price is building on Wednesday’s rebound, as bulls remain hopeful amid renewed fears over the Omicron covid variant after the US detected one case of the new strain and remains poised to extend the mask mandate. Investors remain wary about Fed Chair Jerome Powell’s latest hawkish tilt and its implications on the global markets, especially in the face of the Omicron covid variant-led uncertainty. Meanwhile, traders look past the upbeat US ADP and ISM Manufacturing PMI, as the Fed sentiment dominates ahead of the all-important US Nonfarm payrolls due on Friday.

Read: Gold analysis: Passes below support zone

Gold Price: Key levels to watch

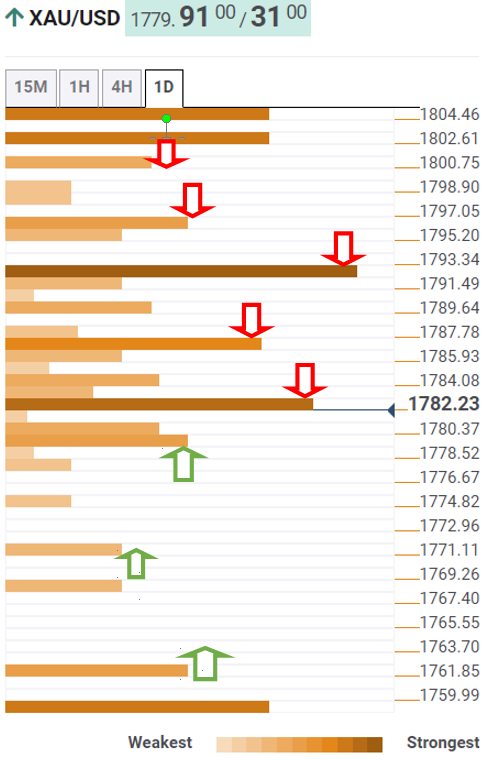

The Technical Confluences Detector shows that the gold price is struggling to extend its recovery momentum above $1,782, as of writing, as that level is the SMA5 one-day.

The next significant resistance awaits at $1,787, which is the Fibonacci 23.6% one-month.

The critical $1,792 is the level to beat for gold bulls to extend the renewed upside. The SMA50, 100 and 200 one-day coincide with the pivot point one-day R1 at that level.

Further up, the previous day’s high at $1,795 will challenge the bullish potential, above which the buyers will target the $1,800 psychological level.

On the flip side, the previous week’s low of $1,779 offers an immediate cushion to gold bulls, below which the multi-week lows at $1,770 could get tested.

Floors will open up towards November lows of $1,759 should the downside pressure mount.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.