US Nonfarm Payrolls set to grow at moderate pace in February after stellar January

- Nonfarm Payrolls are expected to rise by 59K in February.

- The Unemployment Rate is seen holding steady at 4.3%.

- Employment data could lift volatility further while investors navigate through the Middle East crisis.

The United States (US) Bureau of Labor Statistics (BLS) will release the Nonfarm Payrolls (NFP) data for February at 13:30 GMT.

Volatility around the US Dollar (USD) will likely ramp up on the employment report, with investors looking for fresh insights on the US Federal Reserve’s (Fed) path forward on interest rates, especially after the crisis in the Middle East revived concerns over rising inflation.

What to expect from the next Nonfarm Payrolls report?

Investors expect NFP to rise by 59K following the impressive 130K increase recorded in January. The Unemployment Rate is expected to remain unchanged at 4.3%, while the annual wage inflation, as measured by the change in the Average Hourly Earnings, is projected to hold steady at 3.7%.

Previewing the employment report, TD Securities analysts note that they expect job gains to moderate to 90K in February.

“The moderation should be led by healthcare after it posted unusually strong gains last month. Private payrolls likely saw a 100k gain while government likely declined 10k. We also look for the Unemployment Rate to stay at 4.3%, while we flag the risk of an increase to 4.4%. Average Hourly Earnings likely moderated to 0.2% m/m (3.7% y/y),” they add.

Recent employment-related data releases from the US hinted at relatively healthy labor market conditions in February. The Employment Index of the Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) survey edged higher to 48.8 from 48.1 in January (although still in contraction), while the Automatic Data Processing (ADP) reported that employment in the private sector rose 63K, surpassing the market expectation of 50K. Finally, the Employment Index of the ISM Services PMI survey rose to 51.8 from 50.3, reflecting an acceleration in job creation in the key service sector.

How will the US February Nonfarm Payrolls affect EUR/USD?

The USD has capitalized on safe-haven flows and started the month on a firm footing after the US and Israel carried out a joint attack against Iran, causing EUR/USD to come under heavy bearish pressure.

Earlier in the week, the US Senate rejected a resolution that is designed to force US President Donald Trump to seek congressional approval for further military action against Iran. Additionally, CNN reported that a top US official said that the US will start attacking deeper into Iran, noting that the operation is still in its early days.

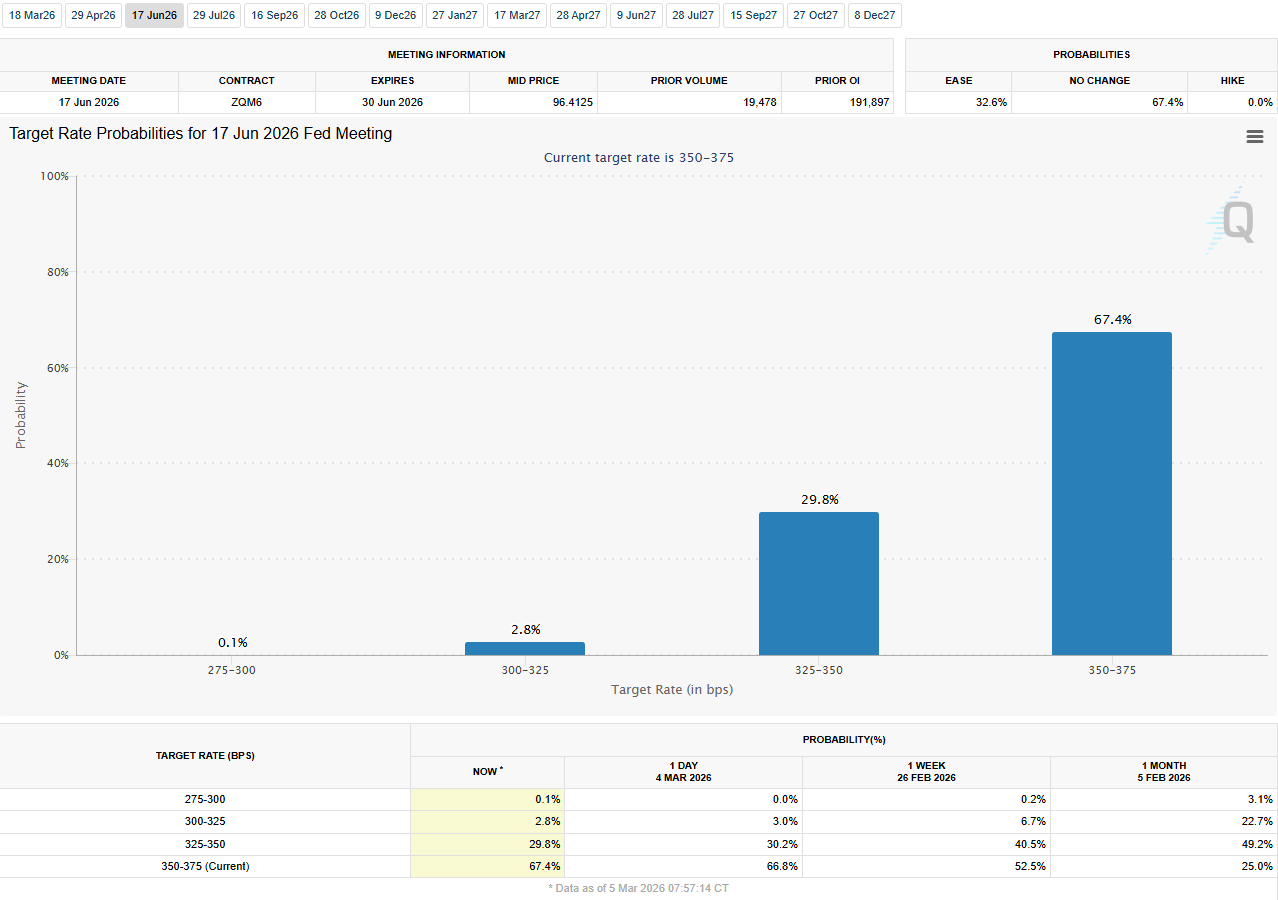

From a monetary policy perspective, investors are keeping a close eye on the impact of the Middle East crisis on energy prices and how that could alter the inflation outlook. According to the CME FedWatch Tool, the probability of the Federal Reserve (Fed) leaving the policy rate unchanged in the next three meetings climbed to nearly 70% from about 50% before the US-Iran war started.

While speaking at the Bloomberg Invest Conference earlier in the week, Neel Kashkari, President of the Federal Reserve (Fed) Bank of Minneapolis, said that it is too soon to know how the Iran war will affect inflation, but acknowledged that it could have an impact on monetary policy.

In case NFP comes in at 70K or higher, and the Unemployment Rate remains steady at 4.3% as forecast, markets could assess the employment data as “good enough” for the Fed to continue to delay interest-rate cuts until the second half of the year. In this scenario, the USD could continue to gather strength and trigger another leg lower in EUR/USD.

On the other hand, a significant downside surprise in NFP, a reading at or below 30K, combined with an increase in the Unemployment Rate, would be required for investors to lean back toward a rate cut in June.

Still, the USD’s losses could remain limited in this case unless there is a de-escalation of the conflict in the Middle East. The most bearish scenario for the USD, fueling a decisive rebound in EUR/USD, would be a combination of a sharp correction in Crude Oil prices with the naval activity in the Strait of Hormuz returning to normal, and an employment report that highlights worsening labor market conditions.

Societe Generale analysts note that they expect a solid NFP print after “four out of four US labour market anecdotes surprised to the upside.”

"Under the current circumstances, it’s a stretch to conclude that good data is reassuring and therefore bullish for risk assets and currencies (bearish dollar),” they add. "We assume that a 30K-70K employment gain should not move the dial and it’s where oil and natural gas prices close the week that we think will govern the price action."

Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for EUR/USD:

“There is a clear bearish tilt in EUR/USD’s short-term outlook. The pair made a daily close below the 200-day Simple Moving Average (SMA) for the first time in a year and the Relative Strength Index (RSI) dropped below 40.”

“1.1500 (static level, round level) aligns as first significant support ahead of 1.1400 (static level, round level) and 1.1300-1.1290 (round level, static level). On the upside, a strong resistance area seems to have formed at 1.1670-1.1700 (200-day SMA, 100-day SMA). The pair would need to clear that hurdle and stabilize to attract technical buyers. In this case, the 50-day SMA could act as the next resistance at 1.1770.”

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.