Gold Price Forecast: XAU/USD bears prod $1,960 support as bank fears ease – Confluence Detector

- Gold price renews intraday low as sellers attack with short-term key support confluence.

- Receding fears of more banking fallouts jostle with downbeat concerns about China to weigh on XAU/USD.

- Talks about inflation, banks become crucial for Gold traders to watch.

Gold price (XAU/USD) drops to a fresh intraday low of $1,955 as bears struggle to retake control, after an earlier retreat, during Tuesday’s European session. The bright metal’s latest weakness could be linked to the market’s optimism surrounding the banking sector as policymakers try hard to allow all means to stop financial markets from busting. Also favoring the XAU/USD sellers could be the mixed headlines surrounding China, mostly downbeat, as traders fear receding growth from one of the world’s biggest Gold consumers.

It’s worth noting, however, that the cautious mood ahead of this week’s key inflation clues from Europe and the US, as well as the mixed comments from the European Central Bank (ECB) and the Federal Reserve (Fed) officials prod the Gold sellers of late. That said, the US Conference Board’s (CB) Consumer Confidence for March, as well as the second-tier housing and activity data, can direct intraday moves of the XAU/USD.

Also read: Gold Price Forecast: 23.6% Fibo support fails, what’s next for XAU/USD?

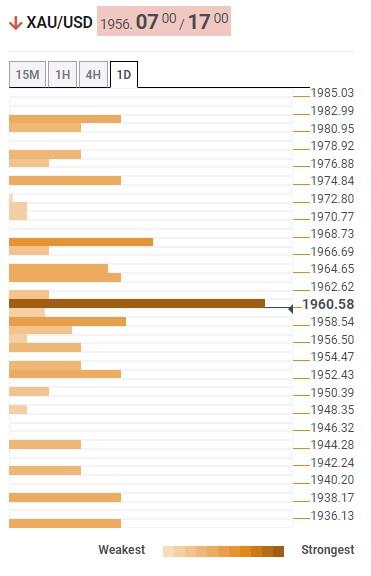

Gold Price: Key levels to watch

As per our Technical Confluence Detector, the Gold price seesaw around the $1,960 level comprising the previous monthly high and 200-HMA. Adding strength to the stated trading filter is the middle band of the Bollinger on the 15-minute chart.

Given the ongoing bearish bias, a sustained downside break of $1,960 could quickly drag the Gold price towards $1,951 support confluence comprising the Fibonacci 23.6% on one-week and one-day.

Following that, pivot point one-week S1, around $1,938, and previous weekly low near $1,936, could challenge the Gold bears.

On the flip side, the precious metal’s successful trading above $1,960 support can allow the Gold buyers to flirt with the Fibonacci 61.8% on one-day and 5-DMA, around $1,968.

Should the XAU/USD remains firmer past $1,968, Fibonacci 61.8% on one-week, close to $1,981, could act as the last defense of the Gold bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.